Institutional Developments Fuel Market Sentiment Shift

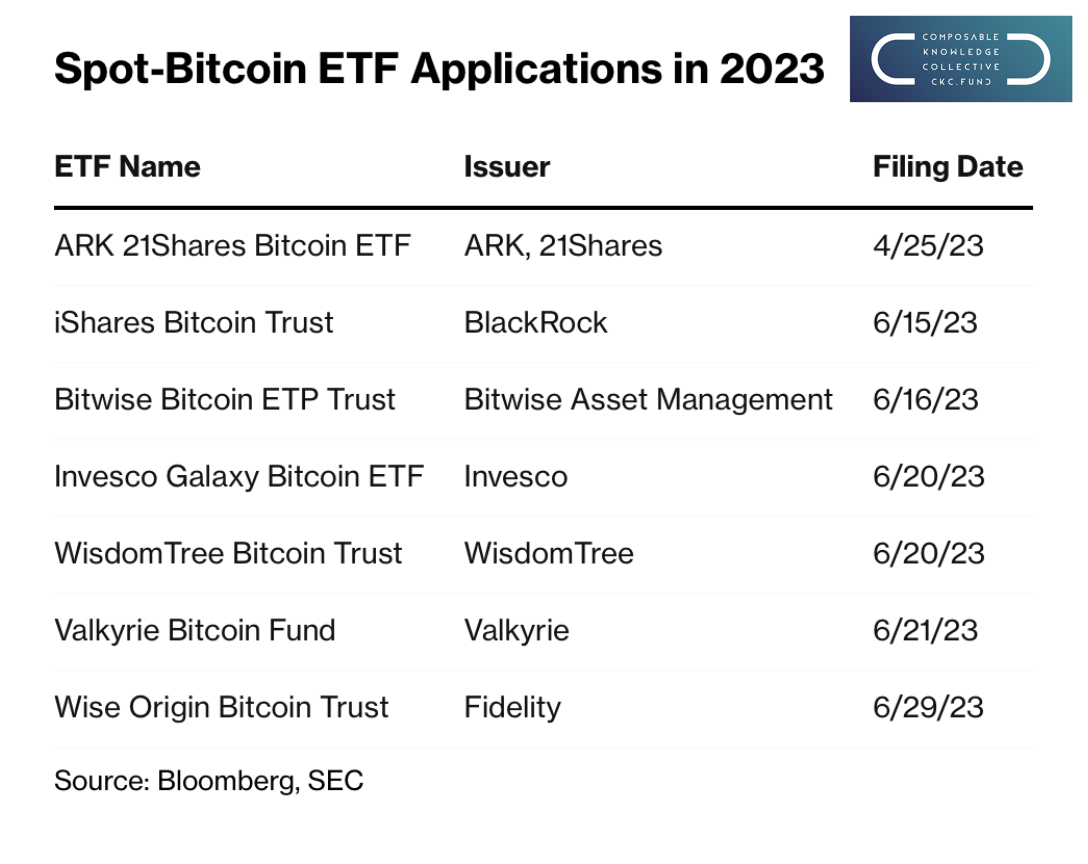

June ushered in a fresh era of optimism in market sentiment, propelled by significant institutional advancements such as BlackRock's spot Bitcoin (BTC) Exchange Traded Fund (ETF) application. The impending entry of institutional giants has assuaged risk-averse attitudes, catalyzing a total cryptocurrency market capitalization surge to $1.21 trillion in June, primarily driven by Bitcoin's stellar performance, which marked a +13.6% growth. In the wake of BlackRock's application, the Grayscale Bitcoin Trust's (GBTC) discount to its underlying BTC holdings decreased to 37% from the previous 44%. Mirroring this move, Fidelity and Wisdom Tree have lodged their spot BTC ETF applications, with Invesco revisiting its application process.

The impending entry of institutional giants has assuaged risk-averse attitudes, catalyzing a total cryptocurrency market capitalization surge to $1.21 trillion in June, primarily driven by Bitcoin's stellar performance.

A New Era: Evolving Crypto Market Structures

The crypto and digital asset product markets underwent significant transformations in June. A notable milestone was the successful inauguration of EDX Markets - a cryptocurrency exchange under the aegis of Charles Schwab, Fidelity Investments, and Citadel. This new exchange offers trading avenues for Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH) through a non-custodial structure. Even though direct access for retail investors remains elusive, EDX Markets has formed strategic partnerships with retail brokerages.

Moreover, a surge in corporate interest in adopting blockchain technology and venturing into the expansive world of Web3 has been observed. A recent report by Coinbase reveals that 52% of Fortune 100 companies are actively engaging in blockchain-based initiatives, 75% of which target financial services. Although initial enthusiasm around 'Metaverse' projects seems to have ebbed due to the industry's cyclicality, an upward trend in corporate adoption of business use-cases incorporating NFTs across various sectors has been noted.

Crypto Exchange Outflows: A Growing Trend

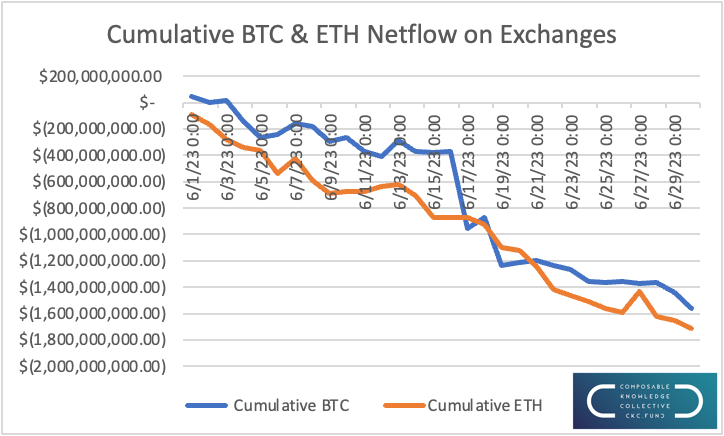

The recent trend of net outflows of BTC and ETH from cryptocurrency exchanges remains consistent. The supply on exchanges has declined 10% for BTC and 4% for ETH year-to-date (YTD), whereas the number of non-custodial addresses with a balance greater than zero has experienced an increase of +11% and +10% for BTC and ETH respectively. This trend points to a growing propensity towards self-custody and accumulation of assets.

A Close Eye on Regulatory Actions

In the face of ongoing regulatory actions by the United States Securities and Exchange Commission (SEC), Binance.US has committed to retaining all US investors' funds domestically until the lawsuit concludes. The SEC has levied charges against Binance.US, alleging a mix-up of customer and exchange funds. Coinbase, on the other hand, is pushing back against SEC allegations concerning token securities on its platform, sticking to the premise of "innocent until proven guilty".

Market Performance: A Glimmer of Hope?

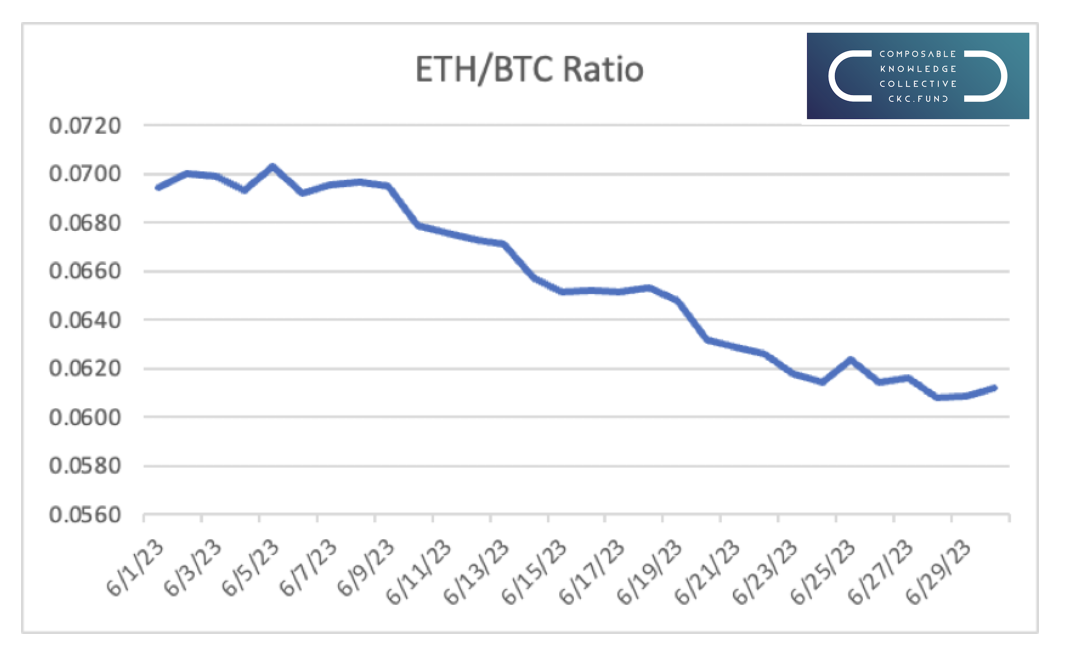

June exhibited a significant performance rebound, with BTC reporting a noteworthy surge of +13.6%, outperforming both ETH and altcoins. The CMBI 10 Index, which encompasses a diverse collection of the largest non-Bitcoin crypto assets, marked a slight decline of -4% month-on-month (MoM), while ETH posted a modest growth of +3.9%. The Market Value to Relative Value (MVRV), a key industry valuation metric, continued its upward trajectory by more than 12% for BTC and 4% for ETH.

Demystifying the complex and ever-evolving landscape of digital assets can be daunting. Our newsletter strives to clarify these complexities with informative insights from industry insiders. To enhance your understanding of this rapidly transforming space, we recommend following CKC.Fund on LinkedIn and subscribing to our bi-weekly newsletter. Stay one step ahead in the world of digital assets with us. For more information, please contact us at info@ckc.fund.

The CKC.Fund Team