Key Takeaways

📅 Legal developments impact July's digital asset markets.

🚀 XRP soars +35%, stabilizes +75% post court ruling.

📈 Notable rises: SOL, ADA, MATIC, SAND.

💸 BTC (+2.5%), ETH (+6%) modest; altcoins surge.

💼 Significance of coin-specific factors now heightened?

📉 BTC, ETH spot prices down; altcoins outperform.

📈 CME plans ETH and BTC ratio futures.

📜 FIT21 bill's potential impact on U.S. crypto markets?

🔍 FSB's recommendations clarify, boost interest.

🤖 OpenAI CEO's Worldcoin faces criticism.

💱 Aave Protocol, Curve launch Ethereum stablecoins.

⬆️ MKR surges 50%, DAI Savings Rate may reach 8%.

📧 Stay updated via CKC.Fund on LinkedIn or contact info@ckc.fund

Overview

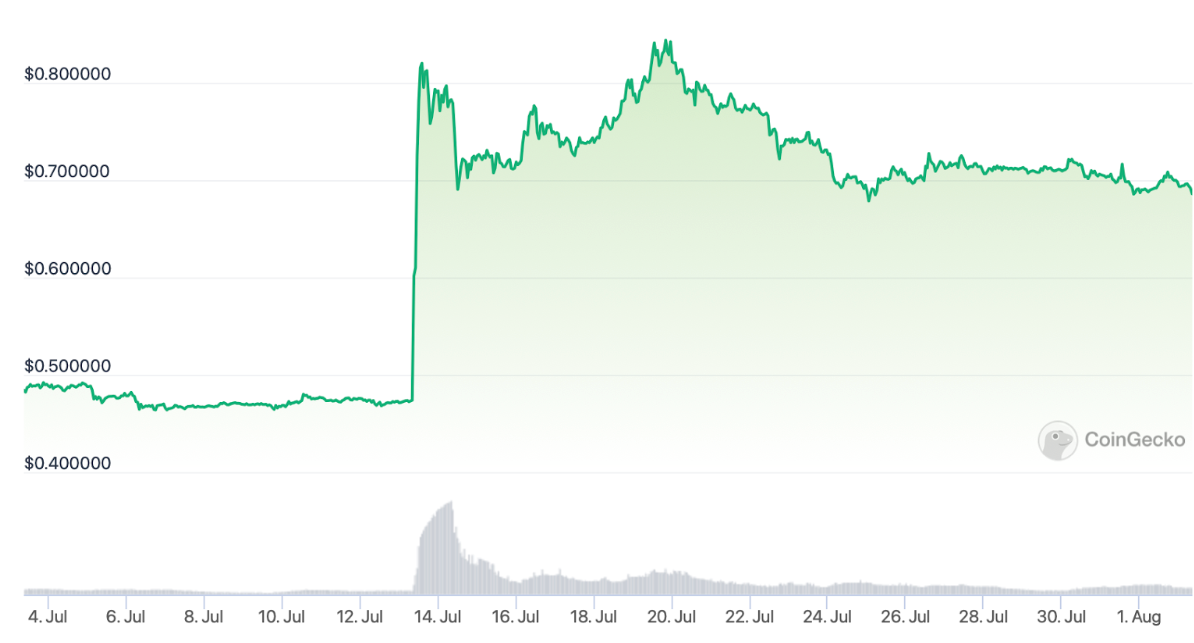

This month, the landscape of the cryptocurrency market underwent a significant transformation driven by recent legal developments within the ongoing SEC vs. Ripple Labs case. Notably, on July 13th, a U.S. district court judge ruled in favor of Ripple, permitting the public sale of its XRP token. Subsequently, several prominent cryptocurrency exchanges promptly reintroduced XRP to their trading platforms.

The market's response was positive, as evidenced by a substantial +35% surge in XRP's value immediately following the announcement. This surge gradually stabilized, culminating in an impressive +75% increase in value by the close of the day. This turn of events reflects the evolving dynamics between regulatory decisions and their impact on the crypto market.

Ripple's legal win fueled crypto market surge. XRP +35%, altcoins up, cap +7.5%. Regulatory sensitivity evident.

The positive price effects extended beyond XRP. Various altcoins implicated in recent SEC actions against Binance and Coinbase also witnessed double-digit gains within a day: SOL surged by 30%, ADA by 27%, MATIC by 18%, and SAND by 14%. Concurrently, Ethereum experienced a 6% uptick, propelling its price above $2000, while BTC maintained its recent range, demonstrating a more modest 2.5% increase. In aggregate, the entire crypto market cap saw a rapid 7.5% rise within a day, underscoring the market's responsiveness to shifts in regulatory and legal dynamics.

Performance Data

In July, major cryptocurrencies like Bitcoin and Ethereum exhibited a period of consolidation following the excitement induced by the Bitcoin ETF in the previous month. In contrast, altcoin prices surged, leading to a more diverse performance in the market cap during July. CKC.Fund asserts that current crypto asset price movements are increasingly influenced by factors specific to each coin. While broader systemic factors within the crypto ecosystem still impact most coin prices, discernible variations are emerging within the top 100 coins. Knowledgeable investors and crypto funds are adeptly factoring in distinct legal judgments and blockchain advancements.

BTC and ETH's spot price performance closed the month with declines of 4.2% and 4.1% respectively, mirroring the trends observed in price movements from April to June. Monthly spot volume saw a reduction of over 20%, with a year-on-year comparison indicating a drop of -53.2% (BTC) and -76.5% (ETH). Concurrently, Chicago Mercantile Exchange (CME) front month futures displayed a daily average open interest increase of +1.8% for BTC and +8.8% for ETH over July. However, the monthly volume of front month futures decreased around 18.5%, although this decline was less pronounced than that of spot volume.

According to Bloomberg data encompassing major large-cap Exchange Traded Products (ETPs) with single-asset exposure, BTC ETPs experienced inflows of approximately $250M USD in July, marking a remarkable ~280% increase for the year. Conversely, July's ETH ETP inflows remained relatively stable. This divergence among single-token ETPs underscores an area where disparities in inflows and volumes are expected to expand, as they are increasingly impacted by specific news and developmental roadmaps.

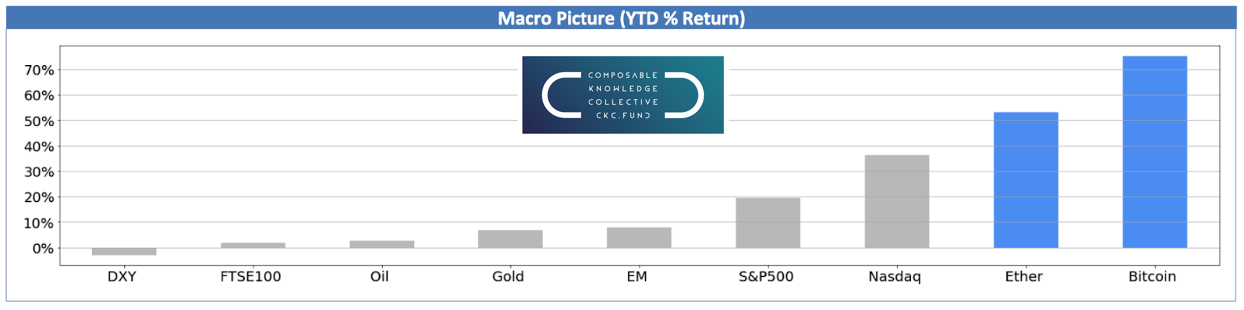

July witnessed positive performance in traditional financial (TradFi) assets, with global equities rallying despite ongoing monetary tightening and rate hikes by the U.S. Fed and the European Central Bank (ECB). Nonetheless, in a year-to-date context, both BTC and ETH have significantly outperformed traditional assets.

TradFi Positive, BTC and ETH Shine; CME Signals Bullish Move

In a positive step for the industry, CME, the global leader in derivatives trading, revealed intentions to introduce ETH and BTC ratio futures upon securing regulatory clearance. This approval is anticipated as early as August 2023 and would enable traders to engage in the bitcoin-ether relationship via a unified futures offering. Such a development would introduce relative value trading possibilities, bridging the gap between crypto investing and the trading options prevalent in traditional financial markets.

Regulatory Action

Leading House Republicans have officially presented the bipartisan "Financial Innovation and Technology for the 21st Century Act" (FIT21) bill, which seeks to reshape the functioning of crypto markets in the U.S. This legislation entails compelling market regulators to formulate precise definitions for "blockchain" and "digital asset" within the framework of existing financial laws. Moreover, the bill calls for the establishment of fresh regulations governing digital asset exchanges (commonly known as crypto exchanges). Notably, regulators would be restrained from formulating rules regarding individual possession and custody of digital assets.

In the middle of the month, the Financial Stability Board (FSB) released its final recommendations concerning the oversight of firms engaged in crypto asset trading, a task assigned by the G20 intergovernmental forum. Additionally, the FSB adjusted its previous recommendations pertaining to stablecoins, influenced by the collapse of TerraUSD and its affiliated digital asset, LUNA. On the whole, these recommendations exhibit a constructive, pragmatic, and relatively straightforward approach. This regulatory clarity is anticipated to provide a marginal market boost, as institutional investors within the region augment their exposure to cryptocurrencies in their investment portfolios.

Blockchain Applications & Digital Asset News

The crypto markets experienced the introduction of Worldcoin, a cryptocurrency initiated by OpenAI CEO Sam Altman. This crypto aims to become the nucleus of the global financial system and drive Web3 identity verification. Despite surpassing 2 million signups by mid-July, the project has faced criticism within the crypto community due to privacy concerns surrounding mandatory biometric verification. Investigations unveiled deceptive practices targeting participants in countries like Indonesia, Ghana, and Chile. Moreover, the project's biometric data collection is under scrutiny in Europe, potentially conflicting with certain countries' privacy laws. Instances of bad actors pilfering login credentials and Worldcoin operators illicitly selling their World IDs have also arisen.

Aave Protocol executed an approved governance decision, launching its decentralized stablecoin GHO on the Ethereum mainnet. This move aligns with a broader industry trend wherein DeFi platforms are introducing their own stablecoins. Likewise, Curve Finance, one of the major decentralized exchanges by trading volume, rolled out its overcollateralized stablecoin earlier in May.

This move aligns with a broader industry trend wherein

DeFi platforms are introducing their own stablecoins.

MKR, the governance token of MakerDAO, witnessed a remarkable surge of over 50% in July. This growth was prompted by the lending platform's contemplation of elevating the DAI Savings Rate to 8%, a substantial increase compared to stablecoin yields on competing lending platforms like Compound and Aave, which generally range from 2% to 3%. Meanwhile, treasury bills are yielding around 5.5%.

Stay Connected

Navigating the evolving realm of digital assets presents its challenges. That's precisely why we've crafted this newsletter—to provide clarity amid the intricacies. Alongside a monthly roundup of pivotal crypto news, we incorporate perceptive commentary from insiders and experts who possess an in-depth grasp of the cryptocurrency landscape. If you're eager to enrich your comprehension of this rapidly evolving arena, we cordially invite you to connect with us on LinkedIn, and feel free to reach out to us at info@ckc.fund with any further inquiries.

The CKC.Fund Team