Key Takeaways

💥 August 2023 brought renewed cryptocurrency market volatility and a significant Bitcoin price drop.

🚀 The month saw anticipation for U.S. spot BTC and ETH futures-based ETFs.

🌊 Bitcoin's orderly drift lower ended with a sharp mid-month "flash-crash."

💪 ETF expectations included U.S. spot BTC ETF and Europe's first spot BTC ETF.

💼 ETH futures ETF applications surfaced amid SEC considerations.

📉 BTC spot performance decreased by -11.2%, with rising futures volume.

📈 Miner confidence remained high despite BTC price challenges.

⛏️ ETH spot performance decreased by -11.3%, with increased CME futures volume.

📈 Robinhood expanded its crypto wallet offerings to include Bitcoin, Dogecoin, and Ethereum.

💰 Despite market fluctuations, cryptocurrency markets displayed resilience and commitment.

📧 Stay updated via CKC.Fund on LinkedIn or contact info@ckc.fund

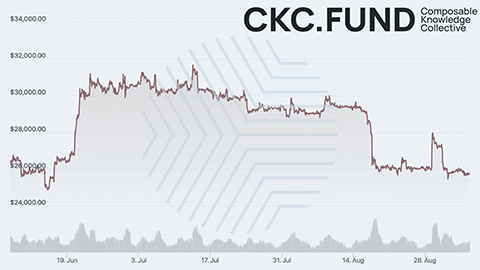

In August 2023, the digital asset markets saw a resurgence in volatility after a period of low trading activity and stable prices. Bitcoin (BTC) experienced a -11.2% decline during the month, partially offsetting its year-to-date gains of +56.8%. This drop in BTC prices was driven by the liquidation of leveraged positions, and a significant event occurred on August 17th when a "flash-crash" led to the largest single-day sell-off of the year, causing a -7.2% decline in BTC prices and liquidating $2.5 billion worth of derivative contracts within hours.

While such abrupt market corrections can be unsettling, they serve a crucial role in maintaining the overall health of the market. They help to mitigate excessive speculation and reduce market froth, ultimately contributing to a more stable and sustainable long-term growth trajectory for the cryptocurrency ecosystem. This highlights the importance of periodic market adjustments in ensuring the resilience and viability of the digital asset landscape.

Pick Up in Volatility

Following BlackRock's filing for a Bitcoin spot ETF in late June, the cryptocurrency market experienced significant momentum. By mid-July, Bitcoin had surged to a year-to-date high of approximately $31,800. However, from that point until mid-August, Bitcoin underwent a gradual decline of approximately 10%, settling around the $29,000 mark. This descent was noteworthy for its remarkable stability, with no single trading day witnessing a fluctuation exceeding 3% over a span of nearly two months, from June 21st to August 16th.

This stability was further evident in the one-month realized volatility of Bitcoin, which dropped below 20%, and the implied volatility for front-month Bitcoin contracts, which reached historic lows of approximately 30%. These observations underscore the period's exceptional steadiness in Bitcoin's price movements, reflecting a market environment characterized by minimal short-term price volatility.

The prevailing calmness in the cryptocurrency market came to an end on August 17th when Bitcoin experienced a notable 10% decline, dropping from $29,000 to $26,000 within just two days. Surprisingly, this decline occurred with limited accompanying market news or catalysts. During this period, the implied volatility for one-month contracts surged by over 10%, surpassing the 40+ volatility mark. In contrast, one-month realized volatility only made a slight uptick, approaching the 30% level.

This disparity between implied and realized volatility is noteworthy as it highlights the abrupt nature of the market correction. Implied volatility often anticipates future price fluctuations, while realized volatility reflects actual historical price movements. The notable difference between the two metrics indicated that investors were preparing for potential turbulence and price swings in the cryptocurrency markets, despite the relatively modest increase in actual price fluctuations during that specific timeframe.

This situation serves as a reminder of the inherent unpredictability and volatility commonly observed in the cryptocurrency space. It underscores the challenges and opportunities that arise from such market dynamics, emphasizing the importance of being prepared for sudden shifts and the need for a strategic approach to navigate this evolving landscape effectively.

It underscores the challenges and opportunities that arise from such market dynamics, emphasizing the importance of being prepared for sudden shifts and the need for a strategic approach to navigate this evolving landscape effectively.

ETF Race Continuing

The cryptocurrency market anticipates an active calendar for the remainder of the year, with expectations surrounding the launch of the first U.S. spot Bitcoin (BTC) ETF and Ethereum (ETH) futures-based ETF. The potential approval of a spot BTC ETF in the United States holds significance as it could provide a new avenue for investors seeking cash-settled exposure to this asset. It's worth noting that, thus far, the U.S. Securities and Exchange Commission (SEC) has rejected all applications for physically backed Bitcoin ETFs.

BTC-linked Exchange Traded Products (ETPs) have a history dating back to 2013 when the Winklevoss brothers filed for the Winklevoss Bitcoin Trust. However, the majority of ETPs available to investors have taken the form of either Exchange Traded Notes (ETNs) or trusts issued in Europe, Canada, or U.S.-issued futures-based ETFs. Regarding the SEC's decision on the current applications for a spot BTC ETF, the market lacks visibility regarding the actual approval date, which adds an element of uncertainty.

In parallel, in Europe, a spot BTC ETF, the Jacobi FT Wilshire Bitcoin ETF (BCOIN), was introduced on Euronext at the end of August. This ETF, originally approved in October 2021, overcame a prolonged delay to become the first spot BTC ETF in Europe. This development in Europe highlights the regulatory divergence between the U.S. and European markets and underscores the growing interest in cryptocurrency investment vehicles across global financial centers.

In August, there were several applications for Ethereum (ETH) futures ETFs. These filings have raised curiosity within the industry, as an ETH futures ETF represents unexplored territory, and the SEC has not granted approval for one yet. It's worth noting that the SEC initially expressed its willingness to consider futures-based cryptocurrency ETFs back in 2021. The first approved Bitcoin (BTC) futures ETF, the ProShares Bitcoin Strategy ETF (BITO), made its debut in October 2021. The potential introduction of ETH futures-based ETFs could offer investors additional avenues to access Ethereum, further establishing the cryptocurrency as a legitimate and viable investment asset class.

Performance Data

In August, the performance of Bitcoin (BTC) spot prices registered a decline of -11.2%, accompanied by a -10.9% decrease in the MarketValue-to-RelativeValue metric for the month. Both BTC spot and CME futures front month volumes exhibited positive momentum, increasing by +10.0% and +16.5%, respectively, on a month-over-month (MoM) basis. Notably, there was a capital outflow of -$167.7 million from select BTC Exchange Traded Products (ETPs), reversing the trend of two consecutive months of inflows totaling $263 million in June and $247.8 million in July. This surge in BTC trading activity was also reflected in the total exchange balance, which experienced a noteworthy +16.2% increase in average BTC balance, returning to levels last seen in mid-2022.

Despite the less favorable price performance of BTC, miner confidence remains notably high. The automated adjustment for BTC's mining difficulty, an indicator of miner competition, rose by +6.2% on August 23rd, extending its upward trajectory since July 2021. Additionally, the BTC miner hash rate also aligns with this positive sentiment, with the monthly average value increasing by +2.1% on a MoM basis.

Similarly, Ethereum (ETH) spot performance concluded the month with a decline of -11.3%. While CME futures front month volume increased by +10.0% on a MoM basis, trusted spot volume decreased by -3.9% over the month. In parallel with BTC, the ETH market witnessed an outflow of -$21.2 million from select ETH ETPs, marking the largest monthly outflow since March 2023. These dynamics highlight the evolving trends in the cryptocurrency market, underscoring both the resilience of miners and the fluctuations in investor sentiment.

In August, the total monthly validator revenue, which includes validator fees and priority fees, experienced a decline of -8.0%, primarily due to reduced network activity during the month. Additionally, the burns of total monthly Ethereum (ETH) also decreased by -13.0% on a month-over-month (MoM) basis. Despite these decreases, the total amount of ETH staked continued to grow, with a notable increase of +5.7% in August. However, the pace of growth in total net ETH staked decelerated by -15.2% when compared to the previous month, July.

Interestingly, despite recent price declines, the heightened trading activity in both Bitcoin (BTC) and Ethereum (ETH), coupled with the increasing confidence among miners, suggests a resilient cryptocurrency market. These metrics indicate that there is sustained interest, liquidity, and a commitment to cryptocurrency markets, providing assurance to long-term investors about the overall health and stability of the market.

Robinhood Expands Crypto Scope

Robinhood is rapidly expanding its cryptocurrency offerings, with significant developments in less than six months since the launch of its crypto wallet. The company is now introducing custody, send, and receive functionalities for Bitcoin and Dogecoin, in addition to facilitating Ethereum swaps. Notably, Robinhood currently ranks as the 5th largest Ethereum (ETH) wallet, with holdings totaling $2.54 billion. Furthermore, the Robinhood-linked wallet also contains a variety of other cryptocurrencies, including 122,076 Bitcoin (BTC) valued at $3.3 billion, 34.1 trillion Shiba Inu tokens amounting to $277.8 million, 4.9 million Chainlink (LINK) tokens worth $29.7 million, and 2.6 million Avalanche (AVAX) tokens with a value of $29.6 million. These developments highlight Robinhood's commitment to diversifying its cryptocurrency offerings and expanding its presence in the digital asset space.

Navigating the complex and ever-changing world of digital assets can be a challenge, but staying informed is key. If you found value in these insights and wish to deepen your understanding of this evolving space, consider connecting with CKC.Fund on LinkedIn. Additionally, if you aren’t already, you can subscribe to our newsletter, filled with tailored digital asset insights. For more personalized guidance, reach out at info@ckc.fund. Connecting with us helps you stay one step ahead in the world of digital assets.

This content is intended for general informational purposes only. CKC.Fund does not render or offer personalized financial, investment, tax, legal, security, or accounting advice. The information provided in this content is provided solely as general information and to provide general education. No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action. This content may contain certain statements, estimates and projections that are "forward-looking statements." All statements other than statements of historical fact in this content are forward-looking statements and include statements and assumptions relating to: plans and objectives of management for future operations or economic performance; conclusions and projections about current and future economic and political trends and conditions; and projected financial results and results of operations. These statements can generally be identified by the use of forward-looking terminology including "may," "believe," "will," "expect," "anticipate," "estimate," "continue", "rankings," “intend,” “outlook,” “potential,” or other similar words. CKC.Fund does not make any guarantees, representations or warranties (express or implied) about the accuracy of such forward-looking statements. Forward-looking statements involve certain risks, uncertainties, and assumptions and other factors that are difficult to predict. Viewers are cautioned that actual results referenced in this content could differ materially from forward-looking statements; and viewers of this content are cautioned not to view forward-looking statements as actual results or place undue reliance on forward-looking statements. Past performance is not indicative nor a guarantee of future results. No content in this content shall be viewed as a guarantee of future performance.