Key Takeaways

📊 Crypto Downturn: Regulatory headwinds in September mirrored crypto market typical decline.

💸 ETH Outperforms BTC: Ethereum's 20.4% increase in 3-month futures, gain signals a market sentiment shift.

🌐 Ethereum's Merge Hurdles: Slower staking and transactions post-Merge highlight challenges.

💳 Finance Embraces Blockchain: Major players like PayPal and Visa are adopting stablecoins.

🚀 Banks Tokenize: Citi and J.P. Morgan's token services mark a significant shift towards digital asset integration in global payments.

💼 Crypto Fund Launch: CKC.Fund's new private fund vehicle for accredited investors, emphasizing risk control and growth.

📧 Stay updated via CKC.Fund on LinkedIn or contact info@ckc.fund

The crypto markets witnessed a downturn in September, a period that's historically challenging for Bitcoin (BTC) and a spectrum of other assets, including the stock market. This cooling trend coincided with the Federal Reserve's hints at another potential interest rate hike, setting the stage for sustained high rates. Simultaneously, the U.S. Securities and Exchange Commission (SEC) deferred decisions on Bitcoin spot exchange-traded funds (ETFs), despite congressional pressure to move forward with approvals.

In parallel, venture capital investments in blockchain ventures dipped significantly to $500 million in September 2023, a decline from the $1.9 billion in the same month the previous year, and $2.7 billion in 2021. This downward trend indicates a cooling of investment fervor within the blockchain space.

Even with a modest 4% gain in September, both spot and 3-month BTC futures on the CME witnessed a reduction in trading volume by 47.3% and 20.0%, respectively. The subdued trading activity was further evidenced by a capital withdrawal of $102.6 million from select BTC ETPs, cementing a second month of consecutive outflows and underlining the cautious investor approach in the current economic climate.

Pick Up in Volatility

Ether (ETH) concluded September with a modest price appreciation of +1.6%, mirroring the upward trend seen in Bitcoin (BTC) as the Market-to-Relative Value also experienced a +6.6% rise. Trading activity, however, softened with both spot and 3-month futures volumes on the CME declining by -25.5% and -9.7%, respectively. Contrasting with BTC's -7.1% dip in front 3-month futures value when measured in U.S. dollars (USD), ETH's futures notably climbed +20.4%, suggesting a pivot in market preference away from BTC.

This shift is particularly significant in light of BTC's traditional dominance over altcoins in less buoyant market conditions. The amalgam of factors, including regulatory uncertainties, a downturn in venture capital funding, and the divergent performance trajectories of Bitcoin and Ethereum, underscore the complex and evolving nature of the crypto market. Such trends emphasize the importance of sustained vigilance and the ability to adapt among those involved in this nascent asset class.

ETH: A Year Since the Merge

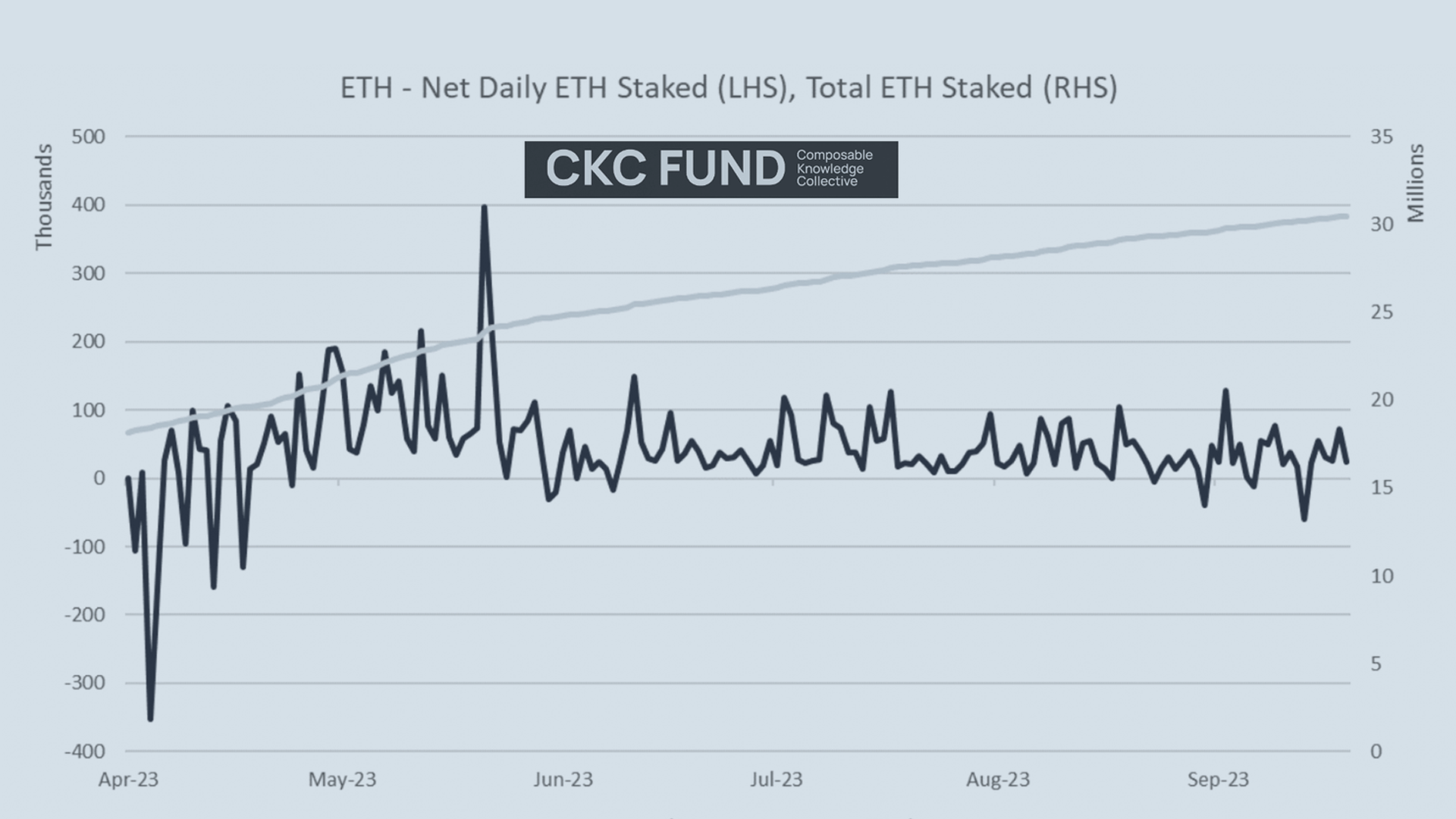

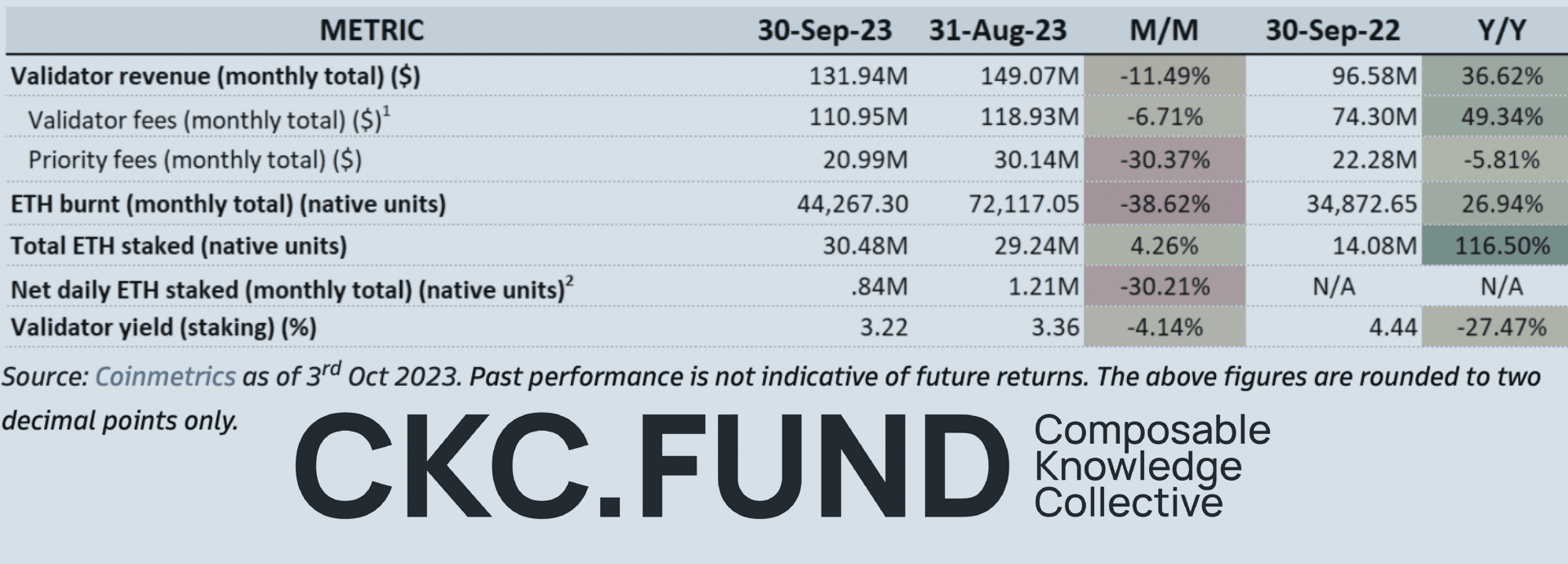

Since the landmark integration of The Merge into the Ethereum network on September 15, 2022, the platform has undergone steady evolution. One year post-Merge, the quantity of Ethereum (ETH) committed to staking has soared by 121.8%, showcasing consistent daily net increases even against the backdrop of enabled withdrawals stemming from the Shapella upgrade. Despite the overall staked ETH climbing by +4.3% within the month, there has been a noticeable slowdown, evident from the -30.2% monthly drop in net staked ETH — marking a trend of decline over two months. Additionally, the network has observed a -38.6% fall in ETH burned and an -11.5% decrease in total validator revenue within the same timeframe. These downturns reflect a diminishing in on-chain transactional activity, underscored by a -30.4% decrease in revenue accrued from priority fees in September, according to data from Coinmetrics.

One year post-Merge, the quantity of Ethereum (ETH) committed to staking has soared by 121.8%, showcasing consistent daily net increases even against the backdrop of enabled withdrawals stemming from the Shapella upgrade.

Post-Merge developments within the Ethereum network, such as the deceleration in ETH staking and a downtick in transaction volumes, highlight the persistent complexities encountered during its transition to a proof-of-stake model. These trends underline the importance of continuous adaptation and vigilant oversight.

Blockchain Applications and Digital Asset Updates: PayPal, Visa & Mastercard

PayPal has recently launched their own stablecoin, PayPal USD (PYUSD), which users can transact with via PayPal and Venmo platforms. The company is extending its crypto ecosystem by integrating with prominent crypto wallets like MetaMask and Ledger, enhancing the liquidity pathways between traditional finance and the decentralized finance sectors.

Visa is stepping into the arena with its support for USDC, a stablecoin tied to the USD, facilitating its flow on the Solana blockchain. This development allows Visa to channel USDC transactions to payment processors like Worldpay and Nuvei via the Circle Account. Similarly, MoneyGram is entering the digital currency space with its non-custodial wallet that bridges fiat currencies with USDC, providing a new avenue for currency exchange for its users.

Mastercard is not far behind in the digital currency innovation race, focusing its efforts on aiding the adoption of central bank digital currencies (CBDCs). Collaborating with blockchain leaders such as Ripple, Consensys, Fluency, and Fireblocks, Mastercard is poised to support central banks in navigating the emerging landscape of CBDCs.

The European Central Bank (ECB) has initiated a probe into the settlement of financial transactions via distributed ledger technology (DLT) platforms within its New Technologies for Wholesale Settlement - Contact Group (NTW-CG). Engaging 55 financial entities, the goal is to unify efforts of eurozone national banks and explore avenues such as wholesale central bank digital currencies (CBDCs).

This exploration by the ECB, alongside recent movements by PayPal, Visa, MoneyGram, and Mastercard towards integrating blockchain and stablecoins, reflects a significant shift towards the blending of traditional financial systems with the burgeoning domain of digital assets. These efforts are collectively casting a spotlight on the pivotal role of blockchain technology in reshaping the financial landscape worldwide.

Tokenized Deposits

Citi has introduced Citi Token Services, a new offering aimed at providing digital asset solutions to its institutional clientele. This service converts customer deposits into digital tokens, facilitating immediate global transfers. Emphasizing enhancements in cash management and trade finance, Citi demonstrated the programmable potential of these tokens through a pilot with the Danish shipping giant A.P. Moller-Maersk A/S.

J.P. Morgan is also venturing into blockchain technology with the development of a deposit token designed to streamline cross-border transactions. While their JPM Coin currently enables intra-bank payments, this new blockchain-based solution has the potential to expand payment capabilities to clients across different banks.

Citi forecasts that blockchain technology's application in the tokenization of both financial and tangible assets could surge to an estimated $4-5 trillion by 2030. Similarly, projections by the World Economic Forum (WEF) are even more optimistic, suggesting figures could surpass $10 trillion within the same period. The launch of services like Citi's Token Services and J.P. Morgan's exploratory blockchain-based deposit token represents a significant leap in digital asset and blockchain technology adoption by the institutional banking sector. These advancements have the capacity to transform global payment networks, streamline cash management, and simplify cross-border monetary transactions, potentially revolutionizing financial services for institutional entities on a global scale.

New Digital Asset Vehicle for Accredited Investors

In September 2023, CKC.Fund, a private fund-advisory firm specializing in digital assets, launched a new private crypto investment fund vehicle for accredited investors. The fund focuses on risk mitigation, yield generation, and fundamental analysis of digital assets. The approach is designed to generate returns by investing in a diversified portfolio of digital assets with a focus on long-term growth. CKC.Fund’s management team has extensive experience in the digital asset industry and is committed to providing a high level of transparency and governance. Accredited investors within the organization's network who are interested in learning more about the fund can contact CKC.Fund directly.

Navigating the complex and ever-changing world of digital assets can be a challenge, but staying informed is key. If you found value in these insights and wish to deepen your understanding of this evolving space, consider connecting with CKC.Fund on LinkedIn. Additionally, if you aren’t already, you can subscribe to our newsletter, filled with tailored digital asset insights. For more personalized guidance, reach out at info@ckc.fund. Connecting with us helps you stay one step ahead in the world of digital assets.

This content is intended for general informational purposes only. CKC.Fund does not render or offer personalized financial, investment, tax, legal, security, or accounting advice. The information provided in this content is provided solely as general information and to provide general education. No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action. This content may contain certain statements, estimates and projections that are "forward-looking statements." All statements other than statements of historical fact in this content are forward-looking statements and include statements and assumptions relating to: plans and objectives of management for future operations or economic performance; conclusions and projections about current and future economic and political trends and conditions; and projected financial results and results of operations. These statements can generally be identified by the use of forward-looking terminology including "may," "believe," "will," "expect," "anticipate," "estimate," "continue", "rankings," “intend,” “outlook,” “potential,” or other similar words. CKC.Fund does not make any guarantees, representations or warranties (express or implied) about the accuracy of such forward-looking statements. Forward-looking statements involve certain risks, uncertainties, and assumptions and other factors that are difficult to predict. Viewers are cautioned that actual results referenced in this content could differ materially from forward-looking statements; and viewers of this content are cautioned not to view forward-looking statements as actual results or place undue reliance on forward-looking statements. Past performance is not indicative nor a guarantee of future results. No content in this content shall be viewed as a guarantee of future performance.