Key Takeaways

🚀 BTC and ETH surged in 2023, +154% and +92%, signaling recovery.

💼 Crypto markets embraced institutions, regulated venues, CME BTC/ETH futures.

📈 BlackRock's Bitcoin ETF filing influenced market sentiment.

💹 GBTC narrowed discount from -40% to -9% after SEC reconsideration.

🔗 BTC as risk-on asset, digital store of value, weaker equities correlation.

💱 Altcoin shift: Investor focus from BTC to Solana (SOL) at $124.

🌐 Bitcoin network growth: $170M in miner fees, increased transactions.

📧 Stay updated via CKC.Fund on LinkedIn or contact info@ckc.fund

The crypto sector witnessed a remarkable turnaround in 2023, bouncing back robustly from the tough macroeconomic conditions of the previous year. This resurgence was most evident in the performances of Bitcoin (BTC) and Ethereum (ETH). Both cryptocurrencies hit their lowest values on January 1st, but this marked the beginning of a significant upswing. Over the year, BTC and ETH recorded impressive gains of +154% and +92% respectively. This recovery unfolded in two key phases: a swift rise from January to February, followed by another substantial increase from mid-October through the end of the year.

Transformative Trends in 2023: Institutional Participation, ETF Momentum, and the Rise of Altcoins Define the Crypto Revival.

The crypto sector witnessed a remarkable turnaround in 2023, bouncing back robustly from the tough macroeconomic conditions of the previous year.

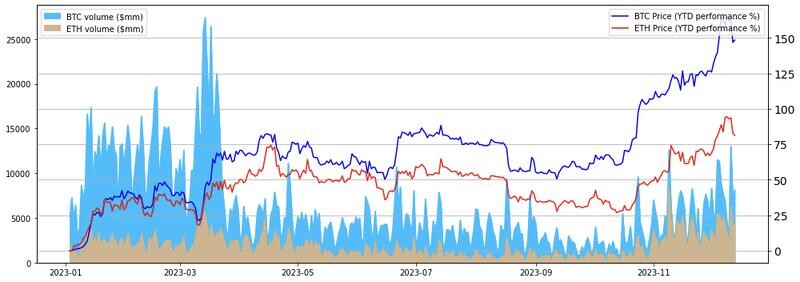

BTC/ETH Trading Volume and Resilient Recovery

In the early months of 2023, the price movements of BTC and ETH were largely influenced by broader macroeconomic conditions, albeit without a specific driving narrative. This could be seen as a turning point from the challenges of 2022. As March concluded, focus shifted to certain U.S. regional banks, notably Silvergate, SVB, and Signature Bank, which are closely tied to crypto companies. Despite initial liquidity concerns, this period saw BTC and ETH hitting yearly highs. The latter part of the year was dominated by discussions about a potential spot BTC ETF in the U.S. As of this writing, applications from major players like BlackRock, Invesco, and Grayscale Investments are pending approval.

Fig 1. BTC & ETH price (YTD performance %) and spot volumes ($mm)

While 2023 marked a recovery in crypto prices, BTC and ETH spot trading volumes remained subdued, except for a surge in BTC's daily spot volumes to $33 billion USD in March.

Institutionalization of Crypto Markets

2023 illustrated a shift in the crypto markets, traditionally led by retail investors, towards greater institutional involvement and regulatory oversight. This year saw the emergence of regulated derivative venues, including Coinbase Derivatives, Cboe, Eurex, GFO-X, AsiaNext, and 24Exchange.

The institutional embrace of digital assets was particularly evident in the derivatives market. CME experienced a steady rise in BTC and ETH futures and options trading. While the first nine months witnessed stable Open Interest for BTC and ETH, October’s price movements drew significant institutional attention, particularly with the prospect of a spot BTC ETF approval and hedging opportunities through derivatives.

There was also notable growth in institutional-grade spot venues like EDX Markets (Citadel/Virtu), Elwood, and Fusion Digital Assets (TP ICAP/Fidelity), alongside increased engagement from institutional asset managers and custodians including Fidelity, BNY, BlackRock, among others.

Rising Institutional Interest in BTC ETFs and ETPs

2023 was a pivotal year for BTC ETFs. BlackRock’s June filing for a U.S. spot Bitcoin ETF sparked a series of similar filings. While many ETPs with BTC exposure existed, a U.S.-issued spot BTC ETF remained elusive. Market sentiment throughout the year swayed with news of potential ETF approvals or rejections. The anticipation of a spot BTC ETF was mirrored in the inflows into existing ETPs and futures ETFs, particularly in the last quarter with significant net inflows.

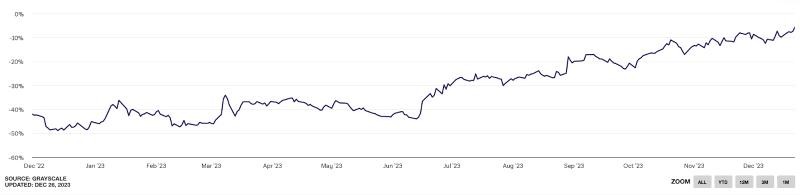

Narrowing GBTC Discount

The Grayscale Bitcoin Trust (GBTC), established in 2013 as the first trust for accredited investors, saw a notable shift in 2023. Currently at $27.2 billion in AUM, GBTC operates without share redemption, leading to secondary market price discovery. A conversion into a BTC ETF, which would allow immediate share creation and redemption, could reduce the GBTC discount. After multiple rejections, the SEC was court-mandated to reconsider Grayscale’s application in October 2023, leading to the GBTC discount narrowing from -40% to -9%.

Fig 2. GBTC discount to BTC.

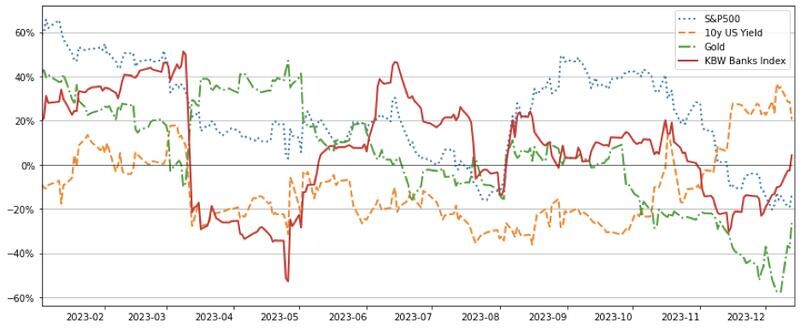

BTC and ETH Cross-Asset Correlation Dynamics

BTC's role in the financial markets has been multifaceted, acting both as a dynamic risk-on asset and as a digital store of value, often seen as a hedge against inflation.

In 2023, its relationship with traditional equities showed a notable shift from previous years. Starting the year with a correlation of +0.60 with equities, BTC's alignment gradually decreased, nearing a negative correlation by August. This trend was particularly evident during the turbulence in the U.S. regional banking sector, where BTC demonstrated notable resilience despite a downturn in the KBW Bank Index, underscoring its reputation as a reliable store of value. Furthermore, BTC's correlation with gold has steadily decreased throughout the year, moving into a negative correlation of -0.40 by mid-year.

Fig 3. BTC and cross-asset correlation YTD (rolling 30-day).

Throughout 2023, BTC and ETH maintained a strong correlation, albeit with some fluctuations. Notably, the correlation experienced a slight dip in April following the Shapella Upgrade. Additionally, as the year progressed, BTC's price performance began to surpass that of ETH, leading to a divergence in their correlation towards the end of the year.

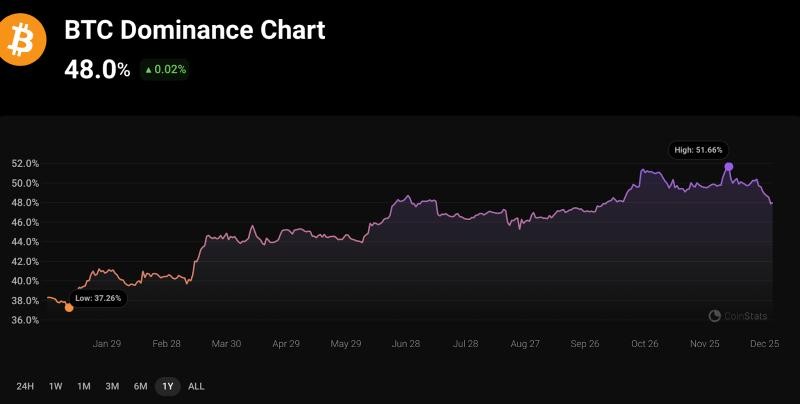

Reallocation and Rotation into Altcoins

The landscape of cryptocurrency investment saw significant changes in 2023, particularly in Bitcoin's market capitalization. Starting the year at a relatively modest 37.26% market dominance, Bitcoin experienced a substantial increase, reaching a peak of 51.66%. However, as November approached, there was a slight decrease in this dominance, signaling a growing investor interest in alternative cryptocurrencies like Ethereum (ETH) and other altcoins.

Bitcoin dominance surged throughout 2023, peaking at 51.66%, and then slightly declined.

Throughout the year, Bitcoin maintained a strong position, but the latter part of 2023 marked a noticeable shift. A key example of this trend was the remarkable performance of Solana's SOL. SOL faced challenges following the FTX collapse but made a strong comeback in the latter part of the year. Starting at a modest $10, SOL's value soared to $124 by December, fueled by a robust demand in its decentralized applications (dApps) ecosystem, featuring projects such as Jito, Jupiter, Magic Eden, among others. Thanks to its low transaction costs, Solana stands as a promising contender for a potential bull market in 2024.

Inscriptions and Ordinals: A New Bitcoin Use Case

The Bitcoin network has evolved to encompass more than just peer-to-peer (P2P) transactions, thanks to the advent of Ordinals. Data from Dune Analytics reveals that since the introduction of the BRC-20 token standard in March, inscription creators have contributed over $170 million in miner fees to the Bitcoin network. This innovation has led to a spike in BRC-20 transactions, reaching 44.5 million, largely driven by a burgeoning interest in memecoins. The year 2023 also marked significant strides in making Bitcoin's Layer-2 solutions more user-friendly for retail investors.

Inscriptions and Ordinals: A New Bitcoin Use Case

The Bitcoin network has evolved to encompass more than just peer-to-peer (P2P) transactions, thanks to the advent of Ordinals. Data from Dune Analytics reveals that since the introduction of the BRC-20 token standard in March, inscription creators have contributed over $170 million in miner fees to the Bitcoin network. This innovation has led to a spike in BRC-20 transactions, reaching 44.5 million, largely driven by a burgeoning interest in memecoins. The year 2023 also marked significant strides in making Bitcoin's Layer-2 solutions more user-friendly for retail investors.

Sustaining Crypto Market Momentum into 2024

The year 2023 witnessed a gradual but steady recovery in the crypto market, culminating in a strong finish in the final quarter across both spot and derivatives markets. This positive trend, coupled with other optimistic developments like the anticipated BTC ETF approvals, sets a hopeful tone for 2024.

If you’re interested in enhancing your understanding of this rapidly evolving space, we kindly suggest you follow us on LinkedIn. Stay one step ahead in the world of digital assets with us. Please feel free to contact us at info@ckc.fund if we can be of any assistance to you in your plans for growth in 2024.

As we embrace the festive season, the CKC team wishes you an exceptionally prosperous and joyous 2024 !

– The CKC.Fund Team

www.ckc.fund

This content is intended for general informational purposes only. CKC.Fund does not render or offer personalized financial, investment, tax, legal, security, or accounting advice. The information provided in this content is provided solely as general information and to provide general education. No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action. This content may contain certain statements, estimates and projections that are "forward-looking statements." All statements other than statements of historical fact in this content are forward-looking statements and include statements and assumptions relating to: plans and objectives of management for future operations or economic performance; conclusions and projections about current and future economic and political trends and conditions; and projected financial results and results of operations. These statements can generally be identified by the use of forward-looking terminology including "may," "believe," "will," "expect," "anticipate," "estimate," "continue", "rankings," “intend,” “outlook,” “potential,” or other similar words. CKC.Fund does not make any guarantees, representations or warranties (express or implied) about the accuracy of such forward-looking statements. Forward-looking statements involve certain risks, uncertainties, and assumptions and other factors that are difficult to predict. Viewers are cautioned that actual results referenced in this content could differ materially from forward-looking statements; and viewers of this content are cautioned not to view forward-looking statements as actual results or place undue reliance on forward-looking statements. Past performance is not indicative nor a guarantee of future results. No content in this content shall be viewed as a guarantee of future performance.