Unraveling the BTC and ETH Performance

In the wake of an impressive Q1 rally where Bitcoin (BTC) and Ethereum (ETH) soared by +70% and +55% respectively, May reflected a period of quietude with reduced trading volumes. BTC maintained a monthly range of $26,000–$30,000, while ETH hovered between $1,750–$2,000, reflecting a period of reduced price volatility and subdued trading activity.

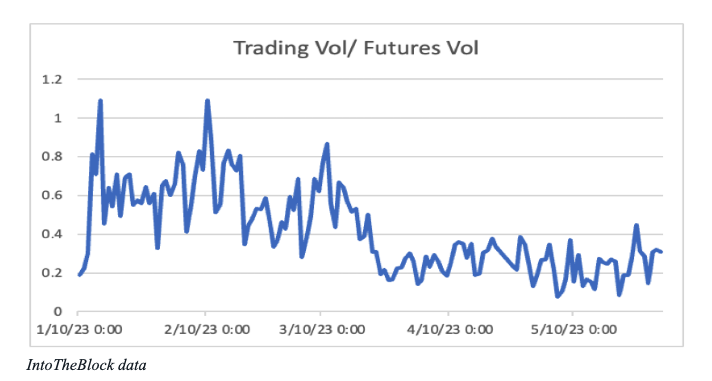

The daily BTC spot to BTC futures volumes plunged from 0.8 in mid-February to 0.2 by the end of May, marking a 12-month low. This reflects an industry shift in market liquidity, pivoting towards futures markets and hinting at the robustness of BTC price movements.

BTC and ETH Correlation: A Declining Trend

The 90-day correlation between BTC and ETH recorded a new year-to-date low, slumping to 84.3% after a high of 95.2% in the previous year. The disparity between the two major cryptocurrencies has become more noticeable since Ethereum's Shapella network upgrade on April 12th. This trend indicates an increasing level of independence between BTC and ETH, offering implications for diversification strategies and investment decisions in the expansive digital asset class.

Bitcoin's Evolution Beyond a 'Store of Value'

The Bitcoin ecosystem is signaling a departure from the pure 'store of value' narrative, reaching a record high transaction volume stimulated by market interest in Ordinal inscriptions and BRC-20 tokens.

In December 2022, Bitcoin developer Casey Rodarmor introduced open-source software enabling users to "inscribe" designs onto sats (the smallest BTC unit), creating "Ordinals" or NFTs on the Bitcoin protocol. This innovation has extended Bitcoin's utility beyond peer-to-peer value transfers, indicating its potential to accommodate diverse digital assets and transactions. This adaptability not only reinforces Bitcoin's versatility but also extends its overall value proposition.

This innovation has extended Bitcoin's utility beyond peer-to-peer value transfers, indicating its potential to accommodate diverse digital assets and transactions. This adaptability not only reinforces Bitcoin's versatility but also extends its overall value proposition.

Record Bitcoin Transaction Volumes and their Implication

On May 1st, the Bitcoin network witnessed a historic single-day transaction count, settling 685,711 transactions. This surge in transaction volume resulted in network congestion on May 7th. However, this elevated on-chain activity turned out to be beneficial for BTC miners. Although a large portion of miners' revenues originates from block rewards, the proportion of revenue from transaction fees rocketed from 2–4% to a high of 42%, stabilizing thereafter. This stabilization amidst high transaction volumes indicates the resilience of the Bitcoin ecosystem in the face of growing adoption.

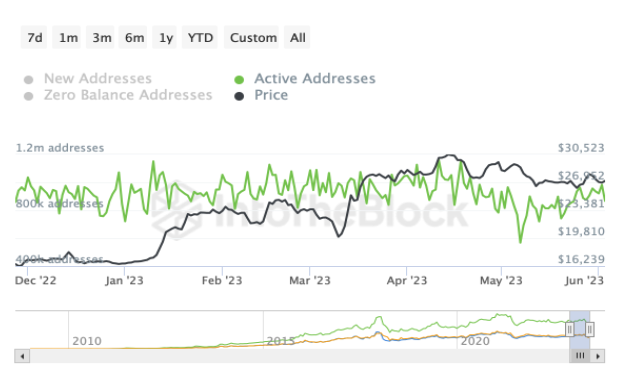

Despite the increase in on-chain activity, the number of daily active addresses fell to around 550K (IntoTheBlock data), a significant decline from the typical range of 800K–1M. This drop might be attributable to higher transaction fees dissuading users from conducting transactions

Ethereum's On-Chain Activity and Transaction Fees

Like Bitcoin, the Ethereum blockchain also observed heightened on-chain activity, with transaction fees hitting a peak of ~$27 USD per transaction. The increased fees were partly attributed to the trading demand for PEPE, a popular memecoin.

The primary news regarding Ethereum was related to the network's finality issues. 'Finality' refers to the point where a block's transactions are confirmed by a supermajority of validators (on Ethereum) or miners, becoming irreversible. Certain technical issues temporarily prevented the Ethereum network from finalizing blocks, but these were subsequently resolved. As a result, Ethereum is solidifying a stabilized version of its proof-of-stake iteration, paving the way for a more efficient and energy-conscious adoption of digital assets.

Navigating the intricate and ever-changing world of digital assets can be challenging. We aim to simplify these complexities through our newsletter, offering insightful commentary from seasoned industry experts. To further deepen your knowledge in this rapidly evolving sector, we invite you to follow CKC.Fund on LinkedIn and subscribe to our bi-weekly newsletter. Keep pace with the digital asset industry and stay ahead of the curve with us. Should you require more information, feel free to reach out to us at info@ckc.fund.

The CKC.Fund Team